Fiji’s 2017-2018 budget is full of big spending promises aimed at winning votes as the 2018 election approaches. Budget papers project a sizeable budget deficit, equal to 4.5% of GDP (with an underlying deficit of 7.8% of GDP). Winners from the budget include civil servants, who see salaries (overall) increase an astounding 18% in one year; recipients of social welfare payments and tertiary scholarships, both of which have been expanded; and workers who will benefit from an increase in the income tax threshold (raised from $16,000 to $30,000). The Bainimarama–Sayed-Khaiyum government has never been one to shy away from deficit spending. However, this budget, delivered amidst positive economic conditions, is particularly notable in this respect.

Budget projections and the deficit

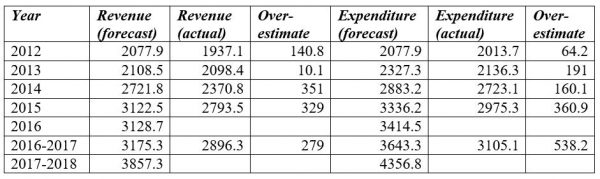

Budget papers project a budget deficit of $499.5 million. Expenditure is budgeted to be $4.35 billion while total revenue is expected to be $3.85 billion. However, we need to take these figures with a grain of salt. The government since 2012 has not once met its budget forecasted revenue (see Table 1).

Table 1. Actual vs budgeted revenue and expenditure

The main reason for this is the projection of asset sales which never materialize, but are nonetheless budgeted again the following year (see Graphs 1 and 2). Previous budget analyses have noted the very significant underlying deficits in past budgets (see here, here and here). This year is no different. If we do not include the revenue from one-off asset sales in revenue projections — and there are strong reasons not to, as these asset sales will reduce future government earnings — the underlying deficit projection is for almost $900 million, or 7.9% of GDP. The other reason to question the 4.5% deficit projection is the fact that asset sales projected in previous budgets have not materialised.